Parking Authority Appoints to Board

James S. Cassel

Week of Thursday, February 24

The Miami Parking Authority has appointed James S. Cassel to its board of directors.

Click here to read the PDF.

James S. Cassel

Week of Thursday, February 24

The Miami Parking Authority has appointed James S. Cassel to its board of directors.

Click here to read the PDF.

By E. Napoletano, Contributor

February 16, 2022

On Feb. 1, the U.S. Treasury Department reported that the U.S. gross national debt surpassed $30 trillion for the first time, a figure that’s incomprehensible at the best of times, let alone when many Americans are still dealing with the economic impact of the coronavirus pandemic.

But as unfathomable as this number is, the national debt can impact ordinary

Americans’ lives.

Daniel Rodriguez, COO at Hill Wealth Strategies, says that if the government wants to maintain the same level of benefits and services to Americans and its international allies without running up both the deficit and the national debt, more revenue will be required.

“The only way to get more revenue is to increase taxes on the American people or reduce spending,” he says. “The government may choose to reduce spending on things like infrastructure, social safety nets, first responders, and education. Those programs have direct impacts on Americans’ day-to-day lives.”

Here’s what the national debt is, the factors responsible for making it rise and fall and how it can impact your life.

What Is the National Debt?

Just like the debt you have is a figure that represents how much you owe your creditors, the national debt represents how much the United States government owes its creditors.

When the U.S. government spends more money than the revenues it brings in each year, it creates an imbalance called a budget deficit. The government must then borrow money to cover its expenses.

It’s more common than not for the government to run a deficit, regardless of which party is in charge. In fact, the government has run a deficit for 77 of the past 90 years and first carried debt after the Revolutionary War in 1790.

How Could the National Debt Impact Consumers?

Congress is responsible for ensuring the government stays funded, but you might still be curious about the national debt and how it relates to the federal deficit.

Here are six ways the rising national debt could potentially impact Americans.

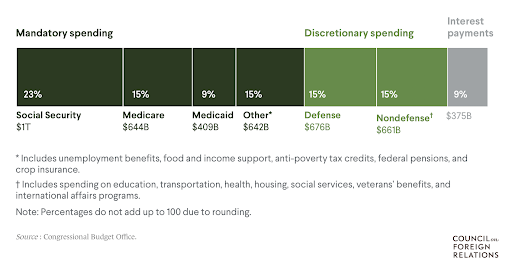

Source: Congressional Budget Office

What Causes the National Debt to Increase?

Sometimes the government needs to increase spending to stabilize the economy, and protect Americans and businesses from unexpected economic conditions.

During The Great Recession (Dec. 2007 to Jun. 2009), for example, Congress passed legislation injecting $1.8 trillion into the economy. But that pales in comparison to the $4.5 trillion the Trump and Biden administrations have pumped into the economy since the Covid pandemic began in March 2020. However, there are other reasons the national debt increases, even during years where spending is moderate and the economy is in good shape

Tax Cuts

On one hand, tax cuts can stimulate the economy and put more money in Americans’ bank accounts every payday. But those same tax cuts mean the federal government brings in less revenue across the board.

For example, the Tax Cuts and Jobs Act of 2017 slashed taxes for individual and corporate payers, but created a $275 billion shortfall in revenue even though the economy grew. The Act caused revenue from corporate taxes to decrease by $135 billion, a 40% reduction from projected revenue.

Rising Healthcare Costs

According to data from the nonpartisan Peter G. Peterson Foundation, per capita healthcare spending in the U.S. is three times higher than in comparable developed nations like the United Kingdom and France. As America’s population ages, more people enroll in Medicare—and older Americans typically require more care. This translates to the federal budget bearing the burden for rising healthcare costs.

Interest Costs

If you’ve ever had a car loan or mortgage, you’re familiar with how much of your payment each month goes toward interest. The same is true of the federal government’s debts. As the national debt rises, the government will pay more interest to keep those debts in good standing.

Using data from the Congressional Budget Office and the Office of Management and Budget, the Peter G. Peterson Foundation estimates that the government will pay a staggering $5.4 trillion in interest over the next 10 years.

Who’s Responsible for the Current National Debt?

In short? Pretty much every administration.

“Regardless of political affiliation, parties in power have run up the deficit through higher spending and lower revenue collection,” says Brian Rehling, head of Global Fixed Income Strategy at Wells Fargo Investment Institute.

While it’s easy to say a particular president or president’s administration caused the federal deficit and national debt to move a certain direction, it’s important to note that only Congress can authorize the type of legislation with the most impact on both figures.

Here’s a look at how Congress acted during four notable presidential administrations and how their actions impacted both the deficit and national debt.

Franklin D. Roosevelt

As the nation’s last four-term president, FDR helped Americans weather an abundance of economic crises. His presidency spanned The Great Depression and his signature New Deal economic recovery package helped lift America out of financial rock bottom. But the most significant increase to the national debt was the cost of World War II, which added roughly $186 billion to the national debt between 1942 and 1945. Congress added $236 billion to the national debt during FDR’s terms, representing an increase of 1,048%.

Ronald Reagan

During Reagan’s two terms, Congress enacted two historic tax cuts that decreased government revenue: the Economic Recovery Tax Act of 1981 and the Tax Reform Act of 1986. These Acts passed by Congress decreased revenue as a percent of the GDP by 1.7% between 1982 and 1990, creating a revenue shortfall that contributed to the national debt increasing 261% ($1.26 trillion) during his administration, from $924.6 billion to $2.19 trillion.

Barack Obama

Over two terms, the Obama administration oversaw both The Great Recession due to the collapse of the mortgage market and the ensuing recovery. In 2009, Congress passed the Economic Stimulus Act, which helped countless Americans save their homes from foreclosure, pumping $831 billion into the economy. Congressional tax cuts accounted for another $858 billion added to the national debt when passed by a strong bipartisan showing. All in all, Congressional action increased the national deficit by 74 percent and added $8.6 trillion to the national debt during Obama’s two terms.

Donald Trump

During his single term, Congress passed the Tax Cuts and Jobs Act in 2017, which slashed corporate and personal income tax rates. Considered by many a boon for the wealthiest Americans and corporations, at the time of its passage, the Congressional Budget Office estimated the cuts would increase the federal deficit by $1.9 trillion.

While the Treasury Secretary estimated that the tax cuts would decrease the federal deficit, the deficit increased from $665 billion in 2017 to $3.13 trillion in 2020. The tax cuts drove some of this increase but multiple Covid relief packages were responsible for the majority of the increase.

The federal debt held by the public increased from $14.6 trillion in 2017 to over $21 trillion in 2020. Public debt and intragovernmental debt (the amount owed to federal retirement trust funds like the Social Security Trust Fund) make up the national debt. It’s the amount of money the U.S. owes to outside debtors such as U.S. banks and investors, businesses, individuals, state and local governments, Federal Reserve and foreign governments and international investors like Japan and China. The money is borrowed to raise the cash needed to keep the U.S. operating. It includes Treasury bills, notes, and bonds. Other holders of public debt include Treasury Inflation-Protected Securities (TIPS), U.S. savings bonds and state and local government series securities.

“The national debt continues to grow as it has not for decades,” says James Cassel, chairman and co-founder of investment bank Cassel Salpeter. “This is the result of this simple concept of spending more money than you have in revenue.” Cassel also mentions that both major political parties have, at times, spoken seriously about a commitment to reduce the national debt yet conversations and strategy remain stalled.

However, the national debt is more commonly used as a bargaining chip when both parties posture about raising the debt ceiling each year. Without raising the debt ceiling, the U.S. would default on its debt obligations. Thus, Congress always votes to raise the debt ceiling (how much money the U.S. government can borrow), but not before parties negotiate on other legislation.

Are We Helpless When It Comes to the National Debt?

In some ways, yes. But there are actions you can take to mitigate the effect of the national debt on your life.

Rehling from Wells Fargo Investment Institute says that while the national debt has increased substantially over the past decade, the U.S. isn’t unique in this regard. The rest of the developed world has seen similar trends. “While these budget trends are unsustainable over the long run, there is no indication that current debt levels are overly worrisome,” he says.

Ed. note: This article has been corrected to more accurately reflect the U.S. national debt increased numbers.

By David Lyons

January 8, 2021

As the fallen startup wunderkind Elizabeth Holmes awaits her sentencing for defrauding investors in her failed blood testing company, Theranos, what does the verdict the mean for venture capital investors in South Florida and elsewhere around the nation?

Holmes’s story is startling. She quit Stanford at 19, became a Silicon Valley executive and founded a blood-testing company that made unfulfilled promises of a technology that could revolutionize the industry. The firm was buttressed by the support of private and public sector titans including computer mogul Larry Ellison, former President Bill Clinton and media baron Rupert Murdoch. Former U.S. Secretaries of State George Shultz and Henry Kissinger sat on the Theranos board.

But in 2015, Shultz’s grandson, Tyler, a company employee, turned whistleblower and raised questions about the truth of Theranos’ claims and the Wall Street Journal launched an investigation.

Holmes last week was convicted in a California federal court of defrauding investors who sank millions into her company. She faces a maximum sentence of 20 years in prison, a fine of $250,000, plus restitution, for the conspiracy count and each of three counts of wire fraud.

The fallout, and South Florida

Post-verdict, commentators are divided on what the trial outcome means for the venture capital industry: Some insist the case was an exception rather than a sign of a flawed system that funnels billions into startups that seek to deliver new innovations to industries ranging from health care to transportation.

RELATED: Former Theranos CEO Elizabeth Holmes guilty of fraud and conspiracy »

Others believe it is symptomatic of a financial space where investors easily can be taken by “fake it until they make it” operators who offer more hype than results.

Meanwhile, South Florida has become a hotbed for startup culture, as more entrepreneurs relocate to the region from the Northeast, California and elsewhere, fueling a growing movement for entrepreneurs who need financing, mentoring and other support that will increase their odds of success.

The South Florida Sun Sentinel asked five experts familiar with the startup industry about the verdicts’ implications and how investors should proceed if they seek to join a burgeoning startup culture filled with both opportunities and risks.

They include:

Impact on venture capital scene

Cassel: I don’t think this is a great “oh my gosh” moment that has come out that should shock people or change things drastically. There has been a very frothy situation with investors very quickly making decisions without maybe spending the time to do appropriate due diligence. And I think to a certain extent that’s what’s happened more in California than other places

Sonn: I think it’s a tip of the iceberg. I’m seeing in the last 10 years, and more so in the last five, the emergence of what we call fintech. Companies are raising small amounts from thousands and thousands of people. In the old days you would go out and raise money in large chunks. Now it’s more decentralized. We’re seeing more and more fraud out there in this type of platform.

Terjesen: I’m very glad this case is so public because people need to know, not only because there are liars and charlatans out there, but also because medical and biotechnology is an extremely risky business and not everyone does well.

Volchek: I’ve heard lots of people talk about focusing more on governance. There is no expectation that every company will be successful. I think they [investors] chalk it up to a loss and move on. I think they will say they will do more diligence. In this case there was so little oversight and so little governance. I was shocked when I saw the company was founded literally more than 15 years ago. This was a long drawn-out process of something that never worked.

How can investors avoid disaster?

Sonn: Obviously when it comes to a private deal, I think audited financial statements are key. People should not be afraid to ask. Number two, check the backgrounds of the principals. Find out if they have past bankruptcies, past tax liens, or past business failures.

You go to wherever the principals are and search the local courthouse websites to see what kind of litigation they’ve been involved in. When people invested with Elizabeth Holmes, how many of them paid attention to the fact she dropped out as a freshman from Stanford? How many paid attention to the fact she had no medical background?

Terjesen: When I look at this case, I feel like there is a halo effect happening such that once that [Holmes] got legitimacy from certain individuals and organizations, everyone else took her at her word.

RELATED: The Elizabeth Holmes story is not about the black and the blinks »

Naturally many people wanted to see a success story of a young smart woman in the medical space. Certainly, multiple people should have dug deeper and there wasn’t very effective governance. I hope it makes people more willing to do deeper due diligence in the future. I personally find it hard to attribute the lack of oversight to one particular individual, whether it was the chairman of the advisory board or the chief scientist.

Joblonski: Most venture capitalists I’ve worked with — if you think about the nature of what it is — it’s a higher risk investment that they expect to be illiquid for a while.

Professional investors in the venture space all do a basic level of due diligence because it’s high risk, because it’s illiquid, because it’s long-term and there is a great opportunity for an exit. The experienced venture investors … they have methods and they sort of get to know these founders and startups and emerging companies.

Volchek: We’re active. We get to know the management teams. We also do a lot of diligence up front. I think our diligence focuses on the founders. We certainly do background checks.

We spend a lot of time with individuals before making investments. We try to get to know folks. What I recommend to individuals is to invest in a fund, which is somewhat self-serving. People invest as a group rather than as individuals. It might be easy to fool one person, but it’s hard to fool 50 people in a room. I think it’s important to have lots of folks looking at something.

What startups should be doing

Joblonski: You don’t want to mislead investors, no matter at what stage of investment you are. That’s just the bottom line. The devil is in the details. It centers around the anti-fraud provisions of state and federal securities laws. The general advice is you don’t mislead. You should be as transparent as you can be. Investors want transparency, even if something isn’t rosy.

RELATED: Were you victimized by South Florida’s most depraved scams? »

Terjesen: At FAU in our classes we are absolutely teaching students how to speak transparently to investors and also how to consistently do due diligence in all parts of the business. We do that through classes and also having guest speakers who are successful entrepreneurs who have been there. And we can also use cases like this to show what happens when they don’t get this right.

What of South Florida’s future?

Joblonski: It’s exciting that our area geographically is seeing the volume of entrepreneurial activity in a variety of sectors that just don’t involve real estate funds. It is something that has been slow to move but has been taking off.

You’ve got a lot of people moving here. You’ve got sophisticated financial services people coming down in droves. You’ve always had the influx of diversified capital. Are we going to be Silicon Valley? No. Are we going to be Boston? No. Maybe we’re going to be our own brand of innovation locale. There is so much opportunity.

Click here to read the PDF.

Click here to read the full article.

By Justin Honore

January 7, 2021

Ira Leiderman, Cassel Salpeter

In late December, the U.S. Food and Drug Administration approved Emergency Use Authorization of Pfizer’s Paxlovid, a pill to help treat COVID-19. The next day another pill, Merck’s Molnupiravir, was approved. This marked a big step in the fight against COVID-19, especially with these pills now available in several states. The pace at which these drugs were given the green light, though, is giving medical professionals questions and concerns. Will Molnupiravir’s and Paxlovid’s accelerated production set a new standard for pharmaceutical pill production, for better or for worse?

Dr. Kishor Wasan, Chief Medical & Scientific Officer at Skymount Medical U.S., has vast experience with drug development. He is an award-winning pharmaceutical scientist and he has published over 240 peer reviewed articles on lipid-based drug delivery and lipoprotein-drug interactions. Dr. Wasan says this accelerated approval and production isn’t a new process for the FDA or pharmaceutical researchers. So why is it drawing so much attention?

“It’s been around. The FDA is not actually skirting their processes: They’re just saying, ‘Hey, use this process.’ What is happening is this authorization is now being used a lot,” said Dr. Wasan. “The general public probably didn’t even know about it because it was probably only used in varying situations people probably didn’t know about.”

Since the initial vaccine was first made readily accessible to Americans, two variants have spread relentlessly, with the current dominant variant, Omicron, overwhelming hospitals. With these compounding factors at play, has there been a forced standard change for drug approval, one that will guide future authorization? Dr. J. Wes Ulm, a physician, medical researcher, and clinical genetics resident at the University of Pittsburgh Medical Center, who has a focus in translational medicine and has applied data-mining tools toward drug discovery and repositioning said, simply, “no.” However, according to Dr. Ulm, the FDA has been willing to shift aspects of its approval approach because of COVID’s public health urgency.

“It’s not only mortality from COVID 19 that’s been so high, but mortality from heart attacks, mortality and morbidity from strokes, from gallstones, from car accidents, from sports injuries, that’s gone up significantly because we just don’t have the staff to care for people,” said Dr. Ulm. “That’s the sort of public health emergency overwhelming hospitals that has led to a genuine rethink at the very least in the EUA process and even potentially for full approval or in the steps leading up to it.”

The key to enabling a fast-tracked approval process lies in Emergency Use Authorization that the FDA has at its disposal. Ira Leiderman, Managing Director at Cassel Salpeter and Company, said this emergency use authorization is one of many tools in the FDA’s tool belt. We asked him why, then, the FDA has been using this approach, and why it could be effective for these different forms of COVID-19 treatments.

“The FDA uses the data collected by the developers of the products looking at safety and efficacy from Phase 1 studies and ultimate efficacy from large Phase 3 studies to grant this emergency use authorization which will allow these companies to sell the products and at the same time allow them to continue collecting data and continue their filing process to get full product licensure,” said Leiderman. “This is not a cutback in quality, it is just the stop gap measure that is one of the tools the FDA has to expedite approval of products that are important and in need for public health purposes.”

At first glance it sounds like steps are being skipped when authorizing “emergency use,” but Dr. Wasan said the benefit risk analysis is heavily weighed. According to Dr. Wasan, all COVID treatments have had a limited number of patients because of the urgency of the decision, but as more data comes in, how the pill is prescribed could change. This limited data was one of the concerns in the Molnupiravir approval process which saw the FDA vote 13-10 in it’s initial recommendation.

“The initial data looked really great, it looked like it was really safe and that it seemed to have significant efficacy, but as they started to get more and more patients, they found that the efficacy actually started to go down and there were safety concerns,” said Dr. Wasan.

Moving forward Dr. Wasan can envision other cases where developers utilize already developed drugs and then modify them like they did for the COVID-19 pill as well as start the conversation with the FDA about the drug approval process before they present it to them.

Click here to read the PDF.

Click here to read the full article.

By Lauren Lamb

Week of Thursday December 21, 2021

Miami-based software company EveryMundo has been bought for $80 million in cash and $10 million based on future stock by PROS Holdings, a software service provider.

“There is a strong cultural fit between EveryMundo and PROS,” said the deal’s broker, Chairman and co-founder of Cassel Salpeter & Co. James Cassel. EveryMundo focuses on landing pages for airlines so they are not outdone by commercial vendors like PriceLine or Travelocity.

“With some businesses, you watch deals fall apart,” Mr. Cassel said. “Not because they’re right or wrong, but just because they have different cultures.”

Mr. Cassel’s son, Seth Cassel, is co-founder and president of EveryMundo. “Today is a monumental day for our team and a next step in our quest to disrupt industry paradigms hindering market growth and opportunity for airlines and B2B organizations,” Seth Cassel said in a press release.

“Airlines want people to engage through their websites instead of using online travel agencies (OTA). The airline gives information about what they are selling directly, for example a deal on a flight to Denver, that the consumer will miss using an OTA,” said James Cassel. The PROS platform includes assets like airline revenue management software, airline digital retail and group sales optimization.

EveryMundo and PROS are a good cultural fit because they spent the time to get to know one another according to James Cassel. “What was important to PROS and EveryMundo was getting to understand how they view technology business but also how they interact with their colleagues and how their business is managed.”

Seth Cassel visited PROS’ headquarters in Houston and members from PROS visited Miami before a deal was made. “The businesses spent time up front to discuss their common vision and common approach. The first goal is to go deeper within one another’s products and see what’s available,” said James Cassel. “The first thing to do in any business situation is look for the low-hanging fruit and be collaborative. They can introduce one another to people who aren’t overlapping and combine them.”

Over the past year, EveryMundo has almost doubled in size. Said James Cassel, “Airlines need more marketing and technology that PROS will help provide.”

Click here to read the PDF.

Click here to read the full article.

In so many ways, the fast-growing EveryMundo – even down to its name – reflects the #MiamiTech story

By Nancy Dahlberg

December 4th, 2021

Homegrown #MiamiTech company EveryMundo, a pioneering leader in fare marketing technology for airlines, has been acquired by the publicly held PROS, a provider of SaaS solutions optimizing shopping and selling experiences.

PROS, based in Houston, will pay $80 million in cash at closing and deliver about $10 million in stock in the future, under terms of the transaction subject to customary conditions.

The good news for #MiamiTech: The EveryMundo team, including leadership, will continue to be based in Miami as part of PROS. EveryMundo plans to grow larger with airline customers, and already serves over 70 airlines globally including American, United, Japan Airlines and KLM. The deal will also help EveryMundo take its solution to other industries, as it started doing in recent months with Greyhound, Tennis Australia and others.

Since 2006, the fast-growing, bootstrapping EveryMundo, under co-founders Anton Diego and Seth Cassel, has helped brands maximize their digital reach and engagement with customers in any channel in the most flexible and profitable way – while creating a superior brand experience and brand loyalty. With its airline customers, this means being able to quickly publish offers on direct and indirect channels that can bring customers back to owned channels, avoiding the increasing fees charged per offer by Global Distribution Systems that limit reach and erode margin.

“Our company and technology were founded on this vision and dream to impact the market in truly innovative ways,” said Diego, EveryMundo’s CEO. “As part of the PROS family, our teams look forward to continuing this mission.”

What the deal brings to both sides

In an interview. PROS CEO Andres Reiner said digital fare marketing was a natural extension of PROS’ digital retail strategy. “For us the vision was always to bring together the marketing and the selling to give brands in our markets the right products to drive demand through their channels,”

Beyond great technology, “the quality of the people and the culture that [EveryMundo] built is really what attracted me the most,” Reiner continued. “They have similar value systems to what we have at PROS. It’s about caring about people and their growth opportunities and creating an environment where everyone can achieve their full potential.”

Cassel, EveryMundo’s president, explained that PROS is the world leader in revenue optimization for airlines, among other things, and that is enabling the airlines to identify the right price at the right moment. EveryMundo broadcasts that price out into the market, engaging the potential passenger with PROS technology for shopping. But PROS serves a wide range of industries outside of airlines where EveryMundo’s technologies could be key to driving more consumers to these brands, he said.

Brands have no choice but to be present everywhere their customer and prospects find themselves, regardless of channel, Reiner added. “With EveryMundo, our collective portfolio gives brands much greater control over direct and indirect channels they participate in to consistently deliver superior brand experiences.”

The EveryMundo co-founders were recently exploring raising private equity for the first time. Engaging in discussions with PROS led to the acquisition outcome that seemed far more compelling and transformational for both companies. “Particularly coming out of the challenges and difficulties that COVID thrust upon us, it just felt like an awesome opportunity to put the company on such a phenomenal acceleration track as part of a much bigger thing now,” Cassel said.

‘We are immigants’

In so many ways, EveryMundo – even down to its name – reflects the #MiamiTech story. CEO Diego was born in Moscow and raised in Havana and Spain before immigrating to the U.S. in high school. The majority of EveryMundo’s 75-member Miami team are immigrants. Powered by that grit and hustle mentality that is Miami, EveryMundo was able to bootstrap and be profitables nearly every year of its existence.

During the pandemic, the company mustered all of that grit and then some to survive, recover, and then thrive again, securing relief loans and quickly creating new products for airlines tailored to the pandemic realities.

It all paid off in a big way.

In 2021, EveryMundo’s worldwide team has grown from 100 to nearly 150 people now. 2021 has also been a banner year for the company’s new customer acquisition, as it added 30 more brands this year, up from 50 at the end of 2020. “We don’t see that trajectory letting up, and we predict 2022 revenue to essentially be a full return to our trajectory prior to COVID,” Cassel said.

The next chapter

When Cassel and Diego looked for financial advisors they considered their options but stayed all in the Miami family: Cassel Salpeter & Co. served as financial advisors to EveryMundo in the transaction, along with Baird, which specializes in the airline industry. Cassel’s father James is chairman and cofounder of Cassel Salpeter and brother Philip is the firm’s managing director. “Working with them was an absolute pleasure and was a nice byproduct of this process,” Seth Cassel said. “I would absolutely wholeheartedly recommend them to anyone who needs financial advisory services.”

Through the years, Cassel and Diego, both selected as global Endeavor Entrepreneurs in 2015, have expressed that they wanted to make EveryMundo a company that makes Miami proud. Mission accomplished, and their story continues with this new chapter. “We’re excited and we hope this is representative of more great things to come for homegrown Miami tech companies,” Cassel said.

Click here to read the PDF.

By Ashley Portero

November 30, 2021

EveryMundo, a Miami company that develops marketing software for airlines, was acquired by Pros Holdings in a deal valued at $90 million.

The acquisition will enable EveryMundo to take the “next step” in its quest to elevate marketing and growth opportunities for airlines and other businessto-business organizations, said co-founder and president Seth Cassel.

“The cultural fit with PROS is what makes this combination so unique and compelling and why we will further transform the brand experiences all businesses deliver,” he added.

Under the terms of the transaction, Pros (NYSE: PRO), a software-as-a-service firm headquartered in Houston, paid $80 million in cash at closing and $10 million in future stock. Baird and Cassel Salpeter & Co. LLC served as financial advisers to EveryMundo in the transaction.

Founded in 2006, EveryMundo provides “fare marketing” technology to airlines – including American Airlines and Japan Airlines Vacations – designed to increase customer engagement and long-term brand loyalty. It also assists other travel-related and recreational brands like Greyhound and Tennis Australia, according to a news release. The company has more than 140 employees.

Pros uses artificial intelligence-powered SaaS to optimize online shopping interactions across several industries, including airlines, automative, consumer goods and health care. Its platform gathers data to understand buyer preferences and deliver personalized recommendations to buyers.

Pros CEO Andrew Reiner said acquiring EveryMundo will help all of its portfolio companies deliver superior online shopping experiences.

“Brands have no choice but to be present everywhere their customers and prospects find themselves,” he added. “But winning in today and tomorrow’s market will require brands to earn more direct engagement and deliver the experiences their customers value most.”

Click here to read the PDF.

By Edward Segal

November 10, 2021

The White House’s new supply chain dashboard is a twice monthly collection of metrics that tracks the progress of delayed imported goods at the ports of Los Angeles and Long Beach and in the economy at large. The true value of the dashboard remains to be seen, however, with the prospect that the measuring tool could have unintended consequences.

Thomas Goldsby is the Haslam Chair of Logistics at the University of Tennessee’s Master’s of Science in Supply Chain Management. He thought the new high-level metrics, “…are helpful first steps but they don’t do anything to save Santa in 2021. They will be helpful in 2024 and beyond but the actions needed now [to address the supply chain crisis] should’ve been taken years ago.”

Today at the Port of Baltimore, the White House said President Joe Biden will detail what his administration has already done to get supply chains moving to help lower prices, speed up deliveries and address shortages.

Improved Communication

Daniel Dreyfus is the global customs leader and executive director of consulting at Ernst & Young. He observed that, “The supply chain dashboard is a step in the right direction to improve communication between the public and private sector so they can work together more effectively to navigate ongoing supply chain challenges.

“Every supply chain is different, if not unique, and each movement is different for reasons that include the impacts of elements beyond anyone’s control, such as issues related to Covid-19 most recently, or something perennial like extreme weather,” he said.

“Having more transparency into the current state of broader supply chain issues may help global supply chain operators and logisticians plan for contingencies more effectively,” Dreyfus concluded.

Too Long Of A Lag Time

Ali Hasan Raza is the co-founder and CEO of ThroughPut Inc., an artificial intelligence supply chain platform. He noted that, “While having visibility from end-to-end may help identify problems, updating the dashboard every two weeks is too much of a lag to actually act on operations. In short, you won’t be able to manage any better, but at least you will be able to see what’s happening.

A Database For Consumers And Distributors

Carla Saunders, operations manager of Consumer’s Health Report, said the dashboard, “will ultimately serve as a database for the consumer and distributors so they can move accordingly and receive updates on major imports such as automobiles, electronics, and other supplies.

She speculated that other “platforms down the road could potentially provide the country with additional accurate data to avoid a country-wide financial crisis, considering that AI has shown promising results in analyzing, determining and preventing financial disasters- the same formula can be applied to other problems within the country.”

Not Much Useful Information

James Cassel, cofounder and chairman of Miami-based investment bank Cassel Salpeter & Co. He said the new White House supply chain dashboard “doesn’t yet provide much useful information to help address [the country’s] logistics bottleneck.

“The dashboard provides information about the problem, but it’s not information that can really help solve the problem. What needs to be provided is a way of addressing whether or not incoming shipments can be diverted to other ports, whether they have available capacity, and whether or not trucks can be diverted to more expeditiously bring in products and get them to their final destinations.”

Taking A Process View

Ravin Jesuthasan, global transformation leader at Mercer, noted that, “The dashboard is made up of three metrics that track the movement of product from when they get here, when they are unloaded and when they hit the stores. The dashboard is a great example of taking a process view of a problem and identifying indicators at the most critical pain points in the process.

“It would be too easy to focus on one metric (e.g., no. of ships at anchor) but that only tells you one part of the story. Organizations experiencing the pains of the widespread labor shortages would be advised to approach the problem with a similar set of process metrics so they can diagnose the key drivers of their specific workforce challenges.”

Will Not Solve Many Pressing Issues

Oren Zaslansky, CEO of Flock Freight, observed that, “While a dashboard will certainly shed some light on the ongoing supply chain challenges, it will not solve many of the more pressing issues that need to be addressed.

For example, trucks that are not utilizing all available space to move freight, thus increasing the need for additional trucks and drivers. If the government was more focused on filling trucks, without impacting dwell times and transit speed, there would be a more significant impact to supply chain management.”

Useful For Forecasting And Planning

Dwight Morgan is executive vice president of business development at M. Holland Company, an international thermoplastic resin distributor. He counseled that, “A central repository for supply chain statistical trends will be useful to help companies forecast and plan. However, it will be important that it not be a political exercise. It might be better for it to be sponsored by a nonpartisan entity rather than the White House.

“Given the dynamics of supply chain challenges and the likely duration, greater frequency [than every two weeks] for a longer period would be in order. In reality, there’s probably little the government can do to quickly alleviate many supply chain pressures, since they are driven by the pandemic and its asymmetrical impacts on the global economy.“

Provides Data That Companies Already Know

Abe Eshkenazi is the CEO at the Association for Supply Chain Management. He noted that, “While the new White House dashboard may provide good information, it’s likely data that companies already know.

“The necessary changes are at every step of the supply chain, data is just one critical aspect. There are simply not enough workers to manage the supply chain crisis, and until more people are hired and trained in supply chain roles, we cannot expect to see drastic improvements.”

A Weapon In Future Trade War Against China?

Michael Gravier is an expert in global supply chain management and a professor of marketing at Bryant University. He said, “the massive scale of evolution in our society and economy demand that we take action, or at least we study what’s happening.

“One fear is that the dashboard will also be used as a weapon in the cold war arsenal for a trade war against China. China will no doubt respond soon with a similar tool. Nobody has forgotten the importance of economics to the fall of the Soviet Union, and the bringing of China into the world trade order was a critical move in that long strategy,” he said.

“In the long run, the dashboard is a brilliant move. We are just at the beginning of understanding global supply chains and how they influence trade…this understanding will inform legislators and policy makers and guide the executive branch in its enforcement and oversight,” Gravier predicted.

What’s Needed Next

Supply chain engineer Barry Bradley noted that the White House dashboard shows the what—one source of truth for the scale of the problems in the U.S. supply chain. What’s needed now to fix the problems is a dashboard for the why—root causes of supply chain bottlenecks stopping goods from reaching their destinations. “With visibility into the why the action need is more clear and bottlenecks are more quickly removed, resulting in a safer, cheaper and more resilient supply chain,” he said.

Click here to read the full article.

By Edward Segal

October 15, 2021

Boeing is facing two new challenges this week to its image, reputation and

credibility.

Yesterday CNN reported that a federal grand jury indicted a former key

executive of Boeing for fraud. They alleged “he deceived the Federal Aviation

Administration while it was first certifying the 737 Max jet that would go on to

have two fatal crashes caused by design flaws.”

“The charges were not against a top executive. Instead, they were against

Mark Forkner, 49, who was the chief technical pilot for Boeing during the

certification process for the jet and is accused of deceiving the FAA during that

process in 2016 and 2017.”

“Forkner’s attorney did not respond to a request for comment, and Boeing

declined to comment,” CNN said.

Boeing is confronting a different issue that involves another one of their

planes.

According to Reuters, the airplane manufacturer said that “some titanium 787

Dreamliner parts were improperly manufactured over the past three years,

the latest in a series of problems to plague the wide-body aircraft.”

The company said the quality issue does not affect the immediate safety of

flights, adding it had notified the Federal Aviation Administration. Boeing is

working to determine how many planes contain the defective part, Reuters

reported.

Boeing did not immediately respond to a request to comment for this article,

and there was no mention of the fraud charges or Dreamliner parts issue on

the company’s website.

Dennis E. Sawan is a personal injury and insurance lawyer at Sawan & Sawan.

He observed that, “Given the callousness allegedly exhibited by Boeing with

respect to the [737 Max] we can expect that the company will face increasing

scrutiny from regulators, who will no doubt bring out the fine-tooth combs

when reviewing Boeing’s safety representations in the future.

“Moreover, companies that place profit over consumer safety have repeatedly

faced multi-million dollar punitive damage verdicts—and Boeing is unlikely to

escape this fate if the allegations in the fraud case prove to be true,” he

predicted.

“While Boeing remains a dominant force in commercial flight, airlines may be

increasingly wary of conducting business in the future —especially if it leads

them to incur additional and unexpected liability for the operation of certain

types of aircraft,” Sawan concluded.

Jonathan Hemus is managing director of crisis management consultancy

Insignia. He said, “There are so many crisis management [lessons] from this

tragic [737 Max] case, not least the enormous power of crises to damage lives,

livelihoods, reputations and businesses.

“These latest developments highlight the critical importance of leaders

instilling a culture that facilitates crisis prevention or swift resolution. Three

years [since] the first 737 Max crash, this latest attention on Boeing shows

how much easier it is to enter the spotlight due to a mishandled crisis than to

exit it. Mishandled crises are not ‘here today, gone tomorrow’ events; their

impact on an organization like Boeing can linger for years, sometime

decades,” he observed.

Joey Smith is the director of aviation services at investment bank Cassel

Salpeter & Co. He said, “Apart from Boeing’s lingering reputational issues and

its mismanagement of the 737 Max crisis, it’s also apparent that there are

massive and systemic issues within Boeing’s culture…”

Smith cited, “… the lack of checks and balances, transparency and

communication between senior management and the rank and file personnel

to do the right thing with safety as the first consideration. These company

culture issues allow for an environment where so many additional crises

develop with additional platforms and their supply chain. Boeing needs more

than just a tweak. It needs an overhaul.

“Additionally, the overhaul needs to address what appears to be

fear, intimidation and compensation issues related to pushing projects

forward, which can open the door to negative results and catastrophic

events,” he concluded.

Boeing has had a lot of experience dealing with crisis situations over the past

several years.

Impact 737 Max Crashes

In November, the FAA lifted its ban against the 737 Max. Caroline Sapriel,

managing partner of crisis management firm CS&A International, told me at

the time that, “It will take time and this black mark on their history may never

be completely erased.”

Billions In Fines

Reuters reported that in January, “Boeing agreed to pay more than $2.5 billion

in fines and compensation after reaching a deferred prosecution agreement

with the U.S. Justice Department over the MAX crashes, which cost Boeing

more than $20 billion.”

Engine Explodes

Last February, three months after the company returned the 737 Max to

service, an engine on a United 777 exploded over Denver, raining debris on a

neighborhood below. Airlines in the U.S., Japan, and South

Korea grounded dozens of the Boeing 777s, and the Federal Aviation

Administration ordered United to increase their inspections of the aircraft.

Potential Electrical Issue

In April, Boeing faced another crisis involving its 737 Max. As reported

by Forbes, the airline manufacturer recommended that a potential electrical

issue in a specific group of 737 Max airplanes be addressed before they fly

again.

Click here to read the full article.

By Justin Honore

October 8th, 2021

At the start of the month, pharmaceutical company Merck dropped big news: it has developed a COVID antiviral drug that would cut hospitalization and mortality risks by 50%. In the drug’s study, patients taking the placebo pill saw 14% hospitalization rate and eight deaths, the trial group with Merck’s drug had only 7% hospitalized, and zero deaths.

But this appears to be just the tip of the iceberg: Kaiser Health News reports at least three COVID antiviral candidates, including Merck’s, going through latestage clinical trials, meaning a variety of COVID drugs could be on patient’s prescriptions here soon. What’ll be some of the positive domino effects to come from approval of COVID antivirals, not only on the pharmaceutical production pipeline, but on the general population’s health? Ira Leiderman, managing director of the healthcare practice at Cassel Salpeter & Co., gave MarketScale his take on the coming treatment

Cassel Salpeter & Co.

801 Brickell Avenue,

Suite 1900

Miami, FL 33131

(305) 438-7700

Sign up today for insights and growth strategies.

Subscribe Now