Minding Your Business/Inside The Deal: Positioning your business in today’s financial landscape

By: James Cassel

January 17, 2016

During the past few years, the financial landscape in South Florida has changed significantly for the better. The market today is flush with capital, a trend that is expected to continue in 2016. Following is some insight into what we can expect to see this year.

First, the fact that interest rates have gone up a little should not have any material effect on the availability of capital in 2016. There should continue to be plenty of money available, and it should not be much more expensive than it has been in the recent past. Interest rates may go up another half percent to 1 percent in 2016, which in and of itself is not likely to have a material effect on the region. With the recent turmoil in the capital markets, the Fed might raise rates more slowly than it would otherwise have.

Banks. During the past few years, many of the smaller or weaker financial institutions have merged or been recapitalized. Today, these institutions are in a much better position than in previous years. Simply put, they are in significantly stronger financial shape and have a need to loan money. One recent noteworthy example is Professional Bank, a boutique Miami-based bank focused on professionals and high-net- worth clients, which recently announced its proposed acquisition of Palm Beach’s FirstCity Bank of Commerce as part of its continued growth in South Florida and the continued consolidation of the industry.

As banks have kept increasing in size, a significant void has been created for small- to medium-size companies to find places to access debt. As a result, they have begun turning to peer-lending sources like Lending Tree, merchant advance companies and other sources of debt from alternative lenders. These types of lenders are generally more expensive but provide an available source of capital. Also available are loans from asset-based lenders, SBICs or SBA loans.

Venture capital money. The past year has seen increased availability of venture capital money — another trend that we can expect to continue to see in 2016. However, the amount of money available locally from local sources is not large.

Although few venture capital firms currently have their headquarters or offices in South Florida, a growing number of East Coast VCs as well as strategic investors and a limited number of West Coast VCs are taking a closer look at the right types of opportunities in South Florida. Consider Magic Leap, MDLIVE and Modernizing Medicine, which received funding in 2015.

As for angel investors, there are growing groups of organized and unorganized angel networks in town. As South Florida continues to become attractive to people from other cities, many of whom are lured by our highly desirable tax rates in addition to our weather, we will continue to see growing numbers of wealthy individuals willing to invest as angels in local companies and other opportunities.

Additionally, the state’s incentive programs led by organizations like The Beacon Council and Miami-Dade County through its Economic Incentives program are also continuing to support and encourage all of these trends.

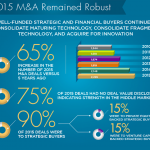

Private equity. Recent years have seen steady growth for the private equity community and increased availability of mezzanine money, a trend we can also expect to continue in 2016. In 2015, South Florida continued to see the growth of locally headquartered private equity firms as well as fund-less sponsors.

In addition, private equity firms from outside of Florida have continued to look for opportunities in the South Florida market that they can take control of and/or invest in. The local PE firms continue to do this as well.

Recognizing these trends and the widespread availability of capital in today’s market, now is a good time for South Florida’s middle-market business owners to begin consulting with experts and thinking about how they can use this to their advantage. By doing so, they can best protect their interests and put their businesses in the best position for continued growth and success.

For one thing, the turmoil in the capital markets the first week of 2016, driven by factors outside of the U.S., raises interesting questions. Some predict that the chance of a recession in 2016 is as much as 30 percent. If this continues, strengthening your balance sheet or bringing in an equity partner might be a very good thing to do at this time. This will protect your downside if you sell a piece of your company and take some money off the table. Also, converting short-term debt to long-term debt will place you in better position to weather any upcoming storm.

James Cassel is co-founder and chairman of Cassel Salpeter & Co., LLC. He may be reached via email at jcassel@casselsalpeter.com or via LinkedIn https://www.linkedin.com/in/jamesscassel

www.casselsalpeter.com

To view original article, click here.