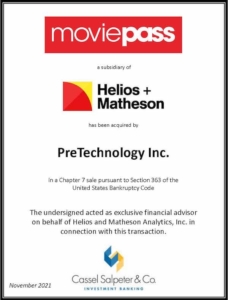

Cassel Salpeter & Co. Facilitates Sale of MoviePass Assets to PreTechnology Inc.

Cassel Salpeter & Co., an independent investment banking firm that provides advice to middle market and emerging growth companies in the U.S. and worldwide, today announced it has successfully facilitated the sale of the assets of MoviePass, Inc. (“MoviePass”), a subscription-based movie ticketing service that allowed subscribers to see several movies for a fixed monthly fee, to PreTechnology Inc.

Cassel Salpeter & Co., an independent investment banking firm that provides advice to middle market and emerging growth companies in the U.S. and worldwide, today announced it has successfully facilitated the sale of the assets of MoviePass, Inc. (“MoviePass”), a subscription-based movie ticketing service that allowed subscribers to see several movies for a fixed monthly fee, to PreTechnology Inc.

The deal sets the stage for a MoviePass relaunch in 2022.

“We were privileged to work with Alan Nisselson, the trustee for the Chapter 7 estates of Helios and Matheson Analytics Inc., to help find a home for the MoviePass assets. We are pleased to have been able to add additional value to the estate despite the challenging environment in the entertainment industry presented by the pandemic,” said Philip Cassel, a managing director at Cassel Salpeter & Co.

The assets were successfully sold in November with the purchaser being MoviePass co-founder Stacy Spikes.

Previously, in April 2020, Cassel Salpeter also assisted the Chapter 7 Trustee with the sale of MovieFone and other assets of the debtor.

About Cassel Salpeter & Co., LLC

Cassel Salpeter & Co. is an investment banking firm with professionals who have more than forty years of financial experience. They deliver smart, straightforward advisory services to middle-market companies across America. With a thorough understanding of their clients’ industries and a keen sense of the economy, the Cassel Salpeter team provides independent, timely advice so clients can capitalize on a rapidly changing global environment. Headquartered in Miami, Florida, Cassel Salpeter is led by James Cassel and Scott Salpeter. Member FINRA and SIPC.