At the Greater Miami Chamber of Commerce’s South Florida Economic Summit on Wednesday, the outlook for 2016 was optimistic with healthy undercurrents of caution.

In the Jungle Island ballrooms, the summit brought together economic development leaders and top industry experts in entrepreneurship, new media, capital investment and the retail sector to share their insights about the region’s economic drivers and the year ahead.

To kick off the half-day summit attended by several hundred people, Tom Hudson, vice president of news for WLRN and master of ceremonies for the event, presented a snapshot of the economy today versus six years ago when the Chamber began holding these annual events. In that six-year period, a million people have moved to the state, a third of them to South Florida, he said. Employment has risen from 2.5 million to 2.9 million, and the unemployment rate has fallen from 10 percent to about half that. Still, median wages have remained flat, he said.

Looking ahead, Ken Thomas, an economist and banking industry expert, believes the economic outlook for 2016 is very good and foresees a maximum of two Fed interest rate increases this year. But he puts up the caution flag for 2017 and beyond: “All bets are off. We will not get out of this decade without a recession.”

On that note, the three chiefs of economic development organizations discussed the need for a powerful war chest at the state and metro levels to attract and retain companies in order to strengthen the economic engine to ride out inevitable downturns.

New companies that the region can recruit grab the headlines, but company retention is just as important, the executives said. Larry Williams, president and CEO of Miami-Dade County’s Beacon Council, offered the example of successfully retaining TUUCI, an outdoor umbrella manufacturer, which was heavily recruited by North Carolina: “Its brand is made in Miami. We need to keep companies who can lean in.”

Bob Swindell, president and CEO of Greater Fort Lauderdale Alliance, and his team recently went to Austin, Texas, to research the tech-innovation culture there and learn how the city has successfully built a brand. He believes part of South Florida’s brand could be tied to the marine industry and the strong university research programs in the marine sciences: “We really don’t tell that story effectively.”

Regional challenges include filling the talent gap in the workforce, the executives said. Williams cited the work of the Academic Leaders Council and the Talent Development Network to combat brain drain and better connect university students with opportunities. Swindell said the Alliance and its partners are working to quantify the talent gap and want to have the funds to fix the problems they find.

Much of the discussion in the summit breakout session focused on the need to build on the economic momentum the region has been experiencing, while heeding the lessons of the last recession and preparing for the next downturn. For many at the summit, that means working to accelerate the tech and entrepreneurship sectors.

Diverse, young, bootstrapped, under the radar, creative and global by nature are some of the descriptions of South Florida entrepreneurship offered up in a panel that included CEOs Brian Brackeen, founder of Kairos, a human emotions analytics startup; Will Fleming, co-founder of MotionPoint, a website translation company; and Michael Simkins, a real estate developer working to develop the Miami Innovation District. To build upon the work of the nonprofit Knight Foundation, which has committed about $20 million in funding to about 165 entrepreneurship projects and organizations, help from the for-profit sector is also needed, said Simkins, who said he has sponsored events and offered free space to entrepreneurs.

Global exposure, big exits (successful sales of companies), and a larger base of mid-sized tech companies can help propel the innovation economy here, the panelists said. Both Fleming and Brackeen acknowledged that investors over the years have tried to lure their companies to California. “Our headquarters has been, is now and always will remain in South Florida,” said Fleming, who in 2000 co-founded the fast-growing Coconut Creek-based company that manages more than 1,500 websites.

Attracting growth capital continues to be a challenge for young entrepreneurs in South Florida, but it’s getting easier at the earliest “seed” stages. “There are almost three times as many angel investors in Florida as in California,” Brackeen said.

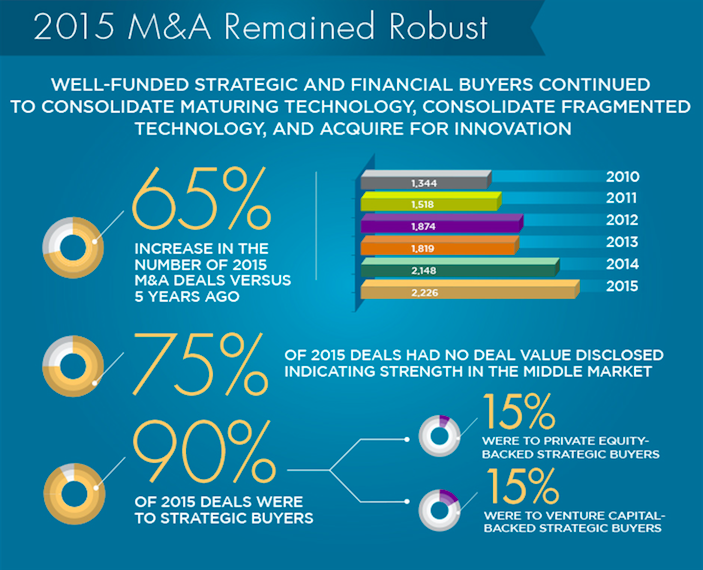

While that may be true, angel investors in California made their money in tech “and they bring a lot to the table we are not getting down here yet,” said James Cassel, chairman of Cassel Salpeter & Co., during a panel about capital availability. But Cassel said private equity firms and family offices are increasing in Florida and so are the number of deals: “The good news is there is plenty of money available for middle-market companies. Finding the right opportunities is the challenge.”

It’s important not to automatically link the innovation economy solely with tech, said Richard Florida, founder of Creative Class Group and an urban affairs expert. “The technology component is only a part of it, and it downplays our strengths,” he said. “Miami exemplifies the creative economy,” which incorporates not only science and technology, finance and law, but also arts, culture, media, fashion, entertainment and the entrepreneurs that are leading the creative innovation. Still, only about 25 percent South Florida’s current workforce is part of the creative economy: “We have to do more.”

In a study of 360 metro areas, Florida has found that the Miami metro area ranks relatively high in technology (40th), falls in about the middle of the pack in talent (138th) — “that’s the brain-drain problem we have to turn around” — but the area ranks 11th for tolerance, he said “These are places that are open to people from all over the world. Open-minded communities win.”

Viacom is betting big on Miami’s creative economy. Juan “JC” Acosta, executive vice president and chief operating officer of Viacom International Media Networks Americas, showed the crowd a presentation on the new Viacom International Studios, which produces shows for Nickelodeon, MTV and Comedy Central worldwide and is located in the Omni area of downtown Miami. It’s an 88,000-square-foot facility with two high-tech 15,000-square-foot sound stages, along with ample office space and post-production, dressing, wardrobe and conference rooms.

“We planted our production flag in Miami,” Acosta said, noting that Viacom International Media Networks has had a headquarters here since 1993. Today, the company produces 21 series in Miami representing more than 750 hours in content, and the company has hired for more than 6,000 jobs, from full-time employees to extras, he said. “We are optimistic our studios will show the value of generating new business in the local Miami community and bring other global players to the market. . . . We hope to create a best of class here in Miami.”

This world-class production hub is exactly the type of anchor institution that a thriving creative economy needs, Florida said. “This is an important foundation stone, along with our universities and colleges, in building a broad creative economy.”